10 Rare Coins Wanted by Collectors: Discover Their Value and Significance in Numismatics

Introduction and Outline: Why Rare Coins Matter

Coins carry history you can hold, compressing politics, art, technology, and trade into a palm-sized archive. That dual identity—artifact and asset—gives rare coins a distinctive role in both collecting and investment. While precious-metal prices influence baseline value, numismatic premiums are driven by factors like scarcity, eye appeal, and collector demand. This article offers a practical and engaging roadmap for readers who want to understand how value emerges, how to evaluate opportunities, and how to manage risk without guesswork.

Here is the outline we will follow, with a brief on what each section delivers:

– Section 1 sets the stage and defines core value drivers, linking history to market behavior and explaining why coins can complement a diversified portfolio.

– Section 2 explores valuable coins for investment, comparing bullion-oriented choices with premium numismatic material, and explaining liquidity, premiums, and pricing dynamics.

– Section 3 focuses on high-value coin collections, showing how themes, completeness, and provenance can compound value beyond the sum of individual pieces.

– Section 4 dives into rare collectible coins, translating rarity from an abstract idea into measurable elements such as mintage, survival rates, condition rarity, varieties, and errors.

– Section 5 concludes with a practical action plan, including sourcing strategies, verification steps, and ways to protect capital while enjoying the hunt.

The importance of this topic lies in the interplay of tangible assets and cultural significance. Coins are portable and globally recognized; they can be sold through dealers, auctions, or peer-to-peer channels, and price discovery is supported by published guides and transaction records. Yet markets can be volatile, and condition nuances matter immensely. By the end of this piece, you will know how to compare coins with similar metal content but different premiums, how to read the signals that separate ordinary items from standout rarities, and how to structure a buying plan that fits your goals, risk tolerance, and timeline.

Valuable Coins for Investment: Criteria, Pricing, and Liquidity

When collectors talk about “valuable coins for investment,” they usually mean two overlapping categories: bullion-oriented coins valued mainly for precious-metal content, and numismatic coins whose premiums reflect scarcity, condition, and demand. The first offers relatively transparent pricing tied to metal markets; the second introduces a premium layer that can grow independently of metal prices. Understanding how these layers work helps investors decide between short-term metal exposure, long-term scarcity plays, or a balanced blend of both.

Consider the components of price you might encounter in listings or negotiations:

– Intrinsic value reflects metal content and spot prices. This acts as a floor but not a guarantee of stability.

– Numismatic premium rewards qualities such as limited mintage, low survival in high grades, and aesthetic appeal. This premium can expand or contract with collector sentiment.

– Transaction costs include dealer margins, auction fees, taxes, and shipping or insurance. These influence the breakeven point and holding period.

Liquidity varies. Bullion-oriented pieces generally sell quickly and close to published melt values, while higher-premium coins require the right audience and accurate grading. Time horizon matters: investors seeking near-immediate liquidity may accept lower premiums, whereas patient collectors targeting condition rarity often hold longer to capture collection-level appreciation. Risk also differs. Metal-oriented positions are correlated with commodity cycles, while premium coins add idiosyncratic drivers like changing tastes or newly discovered hoards.

How do you choose among options without naming specific issues? Start with data you can verify. Examine historical price ranges for comparable coins by metal, denomination, period, and typical grade. Track the spread between purchase and resale quotes from multiple sources. Compare liquidity tiers by asking how many transactions occur in a typical month and how close realized prices are to published guides. If premiums seem unusually high, look for a catalyst such as a very low mintage, a significant die variety, or a pedigree that attracts attention.

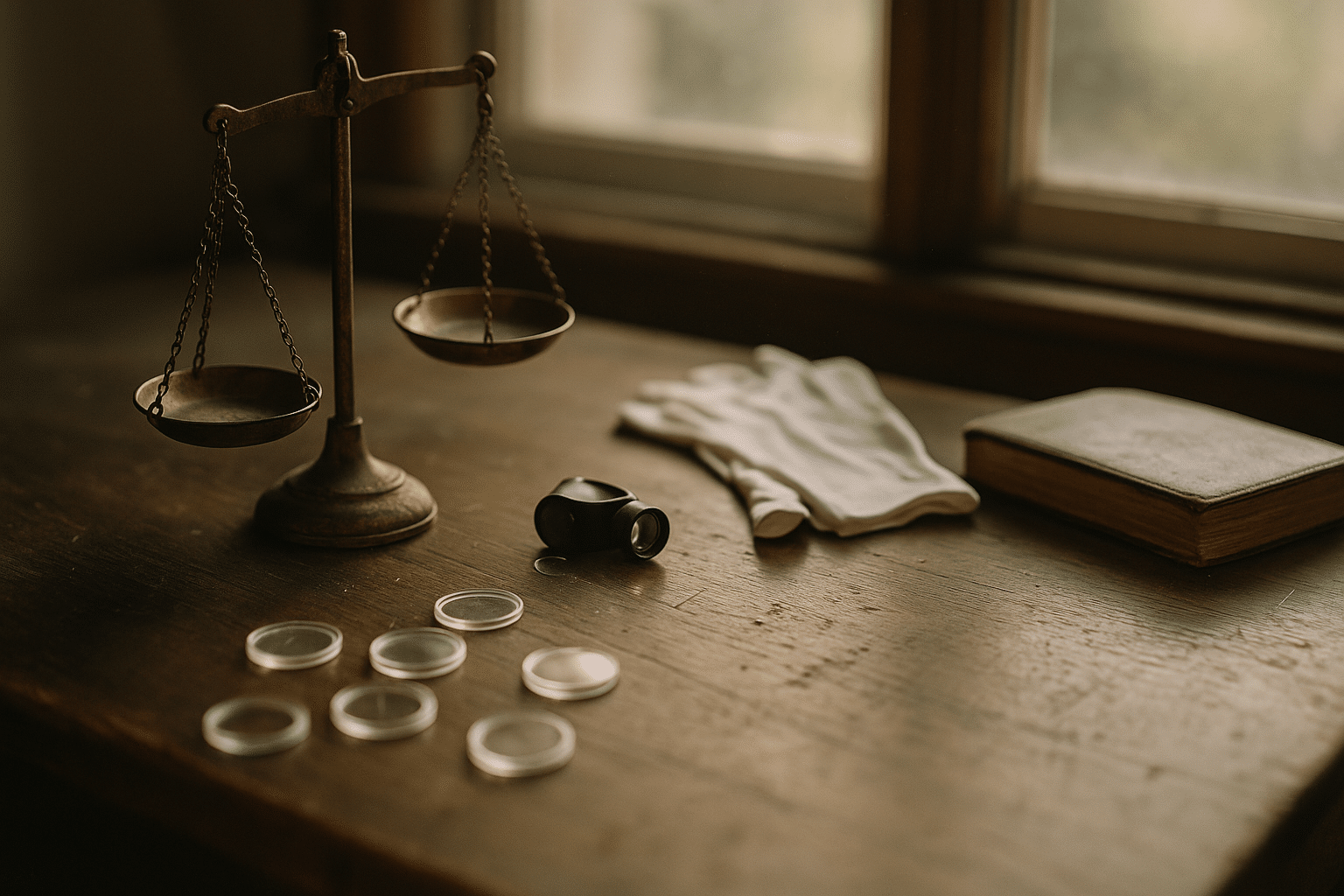

Risk management comes down to process. Buy the coin, not the story. Confirm weight, diameter, and magnetic response. Prefer third-party encapsulation from recognized graders when the value warrants it, but also train your eye so you can spot cleaning, surface alterations, or tooling. Finally, align format with goals: bullion-leaning holdings for flexibility and quick valuation; a select core of premium pieces for long-term scarcity potential; and enough cash buffer to avoid forced sales during slow markets.

High-Value Coin Collections: From Theme and Completeness to Provenance

Individual coins can be impressive, but thoughtfully assembled collections often trade at a premium because they tell a cohesive story. Buyers value the effort behind a theme, the discipline of consistent grading standards, and the completeness that makes research and display effortless. A well-built set transforms a box of items into a curated archive that is easier to sell intact or in carefully planned groupings.

Start with a theme that fits both interest and budget. Some collectors focus on a single century, minting authority, or denomination, while others chase artistic motifs or technological milestones like early steam-press issues. Completeness is a powerful lever because it is scarce by definition. Filling difficult slots—low-mintage dates, scarce varieties, or conditional keys—creates a narrative that casual assemblages lack. Depth is equally important: duplicate pieces across grade bands can illustrate how wear changes design, teaching newer buyers and engaging a broader audience.

Documentation amplifies value. Maintain acquisition notes, prior sale references, population data snapshots, and photographs under consistent lighting. Provenance can be decisive; an item with a documented chain of ownership or a link to a known cabinet often commands extra attention. Museum loans, published appearances, and exhibition histories strengthen credibility and visibility.

Practical considerations protect the collection and its reputation:

– Storage and handling: inert holders, stable humidity, and minimal temperature swings.

– Security and insurance: discreet storage solutions and coverage aligned with updated appraisals.

– Inventory control: a catalog with high-resolution images and condition notes, plus a unique identifier per coin.

– Exit pathways: awareness of timing, seasonal auction cycles, and multiple selling venues to avoid bottlenecks.

For those building toward high-value status, incremental upgrades are more sustainable than sporadic big swings. Replace average examples with higher-grade or more visually attractive pieces when cost-effective. Track how improvements affect the whole: a single key upgrade can lift perceived quality across the set. The aim is not to chase headlines but to cultivate a collection that is coherent, well-documented, and difficult to replicate, attributes that naturally attract discerning buyers.

Rare Collectible Coins: Rarity Drivers, Grading Nuance, and Ten Sought-After Categories

Rarity is more than a small mintage figure; it is the intersection of how many were struck, how many survived, and how many are desirable in a given condition today. Two coins with identical mintages can have very different values if one suffered widespread melting or heavy circulation. Condition rarity adds another dimension: a common coin in worn grades might be surprisingly elusive in mint-state or prooflike form. Learning to speak this language turns a jumble of listings into a map of opportunities.

Key elements to evaluate include:

– Absolute rarity: low total surviving population regardless of grade.

– Condition rarity: scarcity at specific grade thresholds, often confirmed by population reports.

– Die varieties and errors: doubled features, off-center strikes, or overdates that create recognized subtypes.

– Eye appeal: luster, color, strike sharpness, and surfaces free from harsh cleaning or marks.

– Historical context: associations with formative events, changing standards, or short-lived designs.

Grading helps translate nuance. Circulated pieces are assessed by detail remaining and wear patterns, while uncirculated grades emphasize luster, contact marks, strike quality, and overall eye appeal. Many collectors use numeric scales to compare coins precisely; even a small jump within that scale can imply large price differences. Originality matters. Cleaning can dull surfaces or leave hairlines that permanently reduce desirability, even if technical details remain strong. When value is significant, independent authentication reduces uncertainty and improves liquidity.

To connect themes in this article with concrete targets, consider these ten sought-after categories, presented generically to avoid relying on named releases:

– Early national gold pieces with high denominations and short production runs.

– Key-date copper cents from the early twentieth century with low survival in top grades.

– Crown-sized nineteenth-century silver coins from limited-output years.

– Trade issues struck for international commerce that saw heavy circulation abroad.

– Territorial gold from regional mints and assay offices during expansion eras.

– Pattern and trial strikes that previewed designs never adopted for circulation.

– Early proof strikings with small distributions to collectors of the period.

– Dramatic mint errors such as broadstrikes, major off-centers, and significant die clashes.

– Notable ancient silver types with well-centered strikes and attractive patina.

– Early commemoratives with constrained mintages and strong historical ties.

Each category rewards careful study. Verify measurements, compare die diagnostics, consult reference images, and keep a permanent record of findings. In a field where small details drive large differences, a disciplined approach can turn curiosity into confident decision-making.

Conclusion: A Practical Path for Investors and Enthusiasts

Coins combine narrative and numbers, making them appealing to people who enjoy both research and tangible assets. As investments, they can complement broader portfolios by adding exposure to precious metals and scarcity-driven premiums. As collectibles, they offer the satisfaction of discovery and curation. To navigate responsibly, build a routine that emphasizes verification, documentation, and patience.

Here is a concise action plan that respects both opportunity and risk:

– Set objectives and budget: decide your mix of metal exposure versus numismatic premium, and define holding periods.

– Learn the grading language: practice grading with inexpensive coins and compare your conclusions with certified examples.

– Verify before you buy: measure, weigh, and examine under good lighting; seek independent authentication as values rise.

– Keep records: image each coin, record provenance, and log population data snapshots when available.

– Protect and insure: use inert storage, control humidity, and review coverage annually.

– Diversify exit options: cultivate relationships across dealers, auctions, and peer networks to avoid rushed sales.

Think in collections rather than isolated purchases. A focused theme, consistent quality, and careful storytelling can unlock premiums not available to random assortments. When comparing candidates, ask whether value rests mainly on metal content or on attributes that will still matter a decade from now, such as condition rarity or historical significance. Be comfortable walking away when uncertainty is high or documentation is thin. Markets reward clarity and discipline, not speed. If you combine curiosity with method, your cabinet can grow into a coherent, resilient asset—one that satisfies the mind, protects capital prudently, and keeps the thrill of the hunt alive for years to come.